Happy New Year 2026

Damn, the new year is starting out with an unexpected BANG. Not only did we book a fair amount of business in the last quarter of 2025 which we will start and finish in 2026, the last week of 2025 heading into 2026 also brought 2 or 3 new deals on homes we have under construction which will pre-emptively juice 2026. So with the deals booked, and now the new deals moving forward, 2 things are true - 1, the entire year of 2026 becomes viewable and plannable as each peg of certainty becomes fodder for strategic planning, and 2, we have the team in place to take care of business. I have yet to accidently write '2025'.

Another thing that is true that all the hard work we did on the driveway, clearing and foundation end of things is not for naught, but is much diminished because the weather, the weather the weather. Wowza. Couple that with the holidays and December instead of gangbusters was more like a nothing-burger. We still got a lot done, but it wasn’t new stuff, out of the ground stuff. That presents challenges because everything gets crammed together. The trick will be to use breaks in the weather to make the progress we can so we don’t get everything waiting till spring creating real bottlenecks.

One thing that is always true, if it’s bad and challenging for us, it’s bad and challenging for others, and since we are better than most, more vetted than most, it’s a competitive advantage. Although tempering that competitive advantage is we typically have a lot more going on than most.

Our house on 30 acres in Kerhonkson is moving along very nicely, with the exterior tied up tight and the interiors cranking along. This house should be ready for sale to coincide with the Catskill’s spring. Will be interesting to see the price we settle on since it is one of a kind in terms of house size, location, land parcel size, views. Really has everything. I remember last year at this time I had two great houses for sale, and was nervous and sold them quickly for lower than I expected prices just because I incorrectly thought the market would slow. I’m going to try and not do that this time around, and that’s the beauty of paragraph #1, when you start to get some certainty, then you don’t need to be in a rush to off load spec homes. I'm having a lot of fun designing the below -

Interior of a lake house we are building -

As you recall I bought a lot of land in the Fall of 2025 - 7 pieces if I remember correctly, which cost me $600k+ when they would have historically cost $350k. So, the next turn of the speculative wheel has begun, and we should have the results by fall of 2026.

It’s amazing what you can do in this business when you have time and money and expertise and experience.

Some St Pete's building paints and murals.

Currently, it appears we are going to have 4 or 5 pay as you go clients with our ‘your land our homes’ model - meaning they leverage and tweak an original home we have and they own the underlying home, meaning all the improvements they own, and they pay us in a traditional fashion as we make progress. This flip to this type of cash-flow friendly process doesn’t come with a lot of downsides for us.

What it also does is allow me to build out my spec homes (homes without pre-arranged buyers) with less stress, since we have a nice split of booked business and spec business. So it looks like we might build 10 homes this year, which frankly is a lot.

I spent some time in St Petes over Christmas, actually flew down there the day of Christmas. Lovely place and started to get the vibe down there, and I like it. Nice weather, well, is just nice. And perhaps because we just got smothered with an early and full month of mehhhh weather, it might have seemed even more relatively nice than typical. Pickleball, hiking, biking, swimming, working out. It’s not a bad scene or the worst way to whittle away the day.

AI, ChatGPT - Wow, amazing stuff.

I'm a Court Appointed Special Advocate for kids caught up in family court and I've been watching over these three since we plucked them out of dire circumstances 3 years ago - they seem to be thriving.

But, unfortunately, what their new mom will find out is that no matter how challenging the young years are, the older years are a lot more complex. A lot more.

Washington Post writes about Happier Lives in Smaller Homes.

and

Christmas Eve, 2025

If you are feeling blue about anything, it’s always good to compare it with someone else’s unmet expectations - and since anything me or my colleagues are moaning about are typically first-world problems, I’m not talking lack of heat in Ukraine, or food in Africa - I feel that’s an unfair and unhelpful metric to use to keep things in perspective.

Currently, I was looking to lift my spirits up by looking at someone else’s misfortune, I think first in mind would be looking towards those poor souls and families in the western USA skiing locales where there is currently NO SNOW. Like literally NONE. Some spots might have some, but it’s not a lot. Aspen has like ¼ of their slopes open. Many resorts have few to none open. And these vacations start at $10k and go up from there. Mostly non-refundable. As a skier, who goes on family ski vacations, this is actually a pretty depressing big deal. What, sit in your lodge all day instead of shredding the Rocky Mountain peaks. Ugh, not cool. Though, now that I think of it, I'm actually one of those poor souls on January 12 when I'm heading out to take four days of ski lessons in Aspen - 3 weeks is a lot of time for some snow to fall.

Our December has been an eye-opening, 2x4 to the head experience. As I’ve said, a perfect August - early December, and then WHAM, snow storm, single digit weather, more snow, rain storm, single digit weather, more snow, cold… That’s a lot for one month. We have a lot planned for this winter, but if things don’t change I’m scaling back my ambitions a bit. It’s hard on our office staff to continue to pivot every 24 hours, it’s really hard on the guys out there working, and the individual job sites each have their own challenges and since they aren’t right next door in fact spread out over a two hour radius hard to actually know what’s going on with them until someone calls to complain about something, like being stuck or some other emergency.

It also slows our production down, which makes it harder to plan how to keep everyone busy.

Well, enough about our current woes.

Through my annual Christmas party rager and it had a lot of similarities with previous ones including a lack of good photos. Once the party starts, I always forget to get pictures so I have some but nothing that comes close to capturing the essence of the event, which was warm, delicious, fun, crowded, intimate and most importantly, very well-executed.

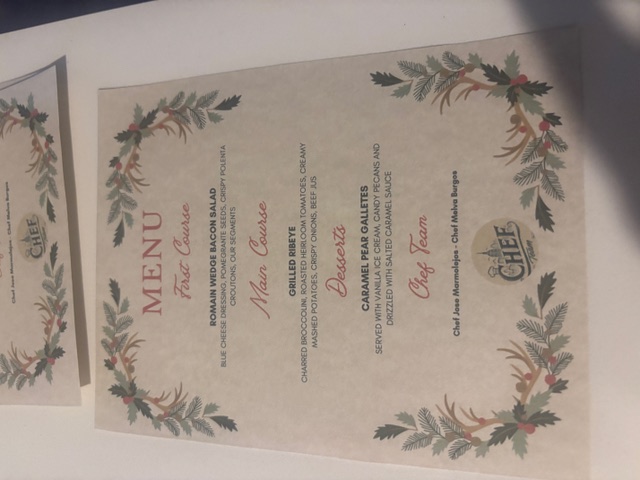

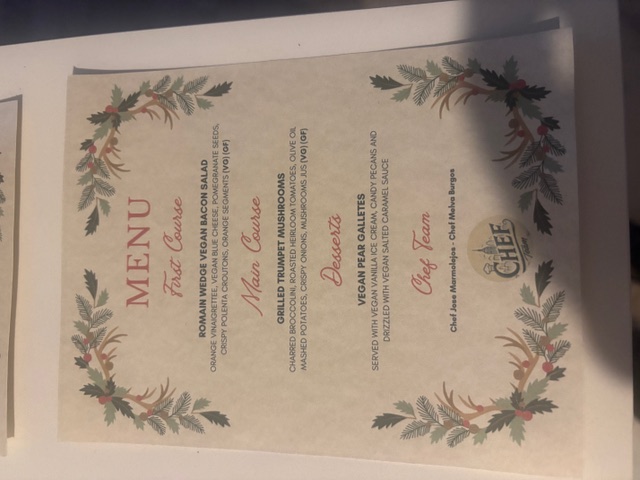

The menus for non-restrictions, non-meat and then vegans. Not really fair to lump the non-meat eaters in with the lonely vegans.

Regular eaters.

Vegans.

Non-Meat

My abilities as a project manager are so off the charts it’s hard to quantify anymore. I can more of less look at any situation and within a few seconds - like one of those cartoons or illustrations or movie special effects - where you can see the synapses connecting and firing - I have a plan which identifies current status, future goals, real and imagined obstacles, talent and resource landscape to get the job done.

A catered sit-down dinner party with hour+ cocktail hour for 30 is a real event. It’s a lot different than a pot-luck serve yourself event -not better or worse, but just a lot different in terms of expectation. Done well, like all well-done event management, it’s like a symphony of layered parts and efforts, building towards the finale.

We had farmers, actresses, writers, politicians, businesspeople, animal rescuers, teachers and others in attendance, all overlapping in some tangible small ways, but merged and meshed in much larger intangible ways, where conversations yielded many unexpected connections and shared experiences, places and efforts.

As I’ve written about, we got a lot accomplished in the fall of 2025 in terms of putting together deals, locating and buying land, and getting foundations in across 3 counties. But then wham, winter, so now we seek a new path forward that is much more complicated and cherry-picked than before.

It’s a complicated holiday season around my family unit, with the death of my friend and son’s alternate father figure looming large and absent in all plans and observances. The broken traditions, the quiet of the Christmas morning, the reduction of gifts under the tree, the lack of a fire in the wood stove, which was John’s specialty. I’m worried about my son as he quietly and not-so-quietly travels this personal journey of which there are no companions or persons to learn from. It’s a solitary journey, with consequences that are far from predictable or eventually positive as you see in the movies or Hallmark shows. It’s a life and game changer, and what emerges as a person is no foregone conclusion.

My son went out and found a tree for his Mom and their home this Christmas. I don't know how they got it through the door and set up.

I’m off to St Pete’s to the condo I bought in the fall of 2024. The building is a lot whiter than I expected, and definitely older than I expected - almost a 55+ community without any written rules. Maybe that’s St Pete’s in general, not sure. It’s sort of embarrassing to have accidentally bought into The Villages, that famous gigantic FL 55+ community - I’m joking, maybe, but so far, the priorities and dialogue is more like a Sunday morning of Karens than an international cadre of residents with kids and lives. A bunch of retirees is a crowd with a lot of time on their hands. I’m thinking even if it’s not for me - which is not a foregone conclusion - it should be a strong rental option with high rents and serious annual depreciation to help offset some income.

The economy is so weird. I know the impacts of inflation are real, and the media tells us all the time about how people are living paycheck to paycheck, which I have no reason to doubt. But everywhere I’m going things are jammed up - Newark Marriott, sold out. Enterprise Car Rental St Petes, sold out, airplanes at capacity. Can’t explain it one way or another but I’m running into a lot of anecdotal evidence that at least some segment of America is on the move in a big way.

Merry Christmas to all.

We removed the longstanding bunk beds from my Son's room so now it's more grown up for him.

Travelogue, Costa Rica 2025

In the north-central volcanic highlands of the Central American country of Costa Rica, I sit on my terra-cotta veranda, bedecked with hammock, two rocking chairs, indirect sunlight casting shade from the leafy trees blowing in the intermittent breeze. A tree being cut down, first cracking then falling, gravity-assisted rustle through through its neighbor trees. A hummingbird flitters by. A rooster crows, pauses, crows and goes silent.

A clank clank clank of the hammer on metal as a stable hand reshoes a pride of horses, a dog barks far off, always dripping water from someplace near and Germans and French speak insularly in this out of the way lodge - The Rinconcito Lodge - on the edge of the volcano region, on the edge of Rincon de la Vieja.

This is day 11, maybe 12 of this 3rd annual Costa Rican trip, the 2nd with my son, two of his friends and wingman-nephew Eli. Again landing in the airport in the city of Liberia, 2 hour drive to a hightop home in Tamarindo, then off to a few days in Playa Grande, and then into the volcanic mountains sporting hot springs, dense overhead cover and organized ant marches that can blow the mind.

By day 12, especially if you are working while resting, you’ve barely scratched the surface of rest and recovery. Since we were so busy back home, I’ve been directing traffic daily, which is not really what I should be doing from a rest and recovery vantage, but required from a ‘we got a lot of moving pieces going on and in the end it’s my money at stake’ point of view.

You might think it’s a fortunate thing that I was away when the first real blast of winter came through, covering the northeast with 6-8” of snow and delivering artic single digit temperatures, and you’d be right. But only because my team did a hell of job without me - and it’s not easy, being pummeled early in the season when you are in the business end of putting 5 new houses in the ground across 3 counties.

The problems can by myriad and somewhat disastrous to be caught mid-stream like this - but in our case, each vendor dialed in and took care of their end of the problem. It might be some concrete blankets to help the concrete set, perhaps a quick set concrete. Maybe the framers have to spend half a day shoveling out before they start - the basement, all the lumber, lurching around in 8” of snow, type of thing. Not an easy lift, but veterans will suck it up and soldier on.

Last winter, the cold hit right around this time, maybe a week later, and then stuck around through April. Tough, long, cold, dark winter. Then I think it rained for a 2 months. Then it got HOT. And then we literally had some of the most temperate, most sunny, most day in day perfect weather until last week. That’s exactly how you get caught - you get lured into thinking the moderate nature of the nature will remain. Then bam, 2x4 to the head.

We surfed; jet-skied; swam; ziplined; horsebacked; hiked; and road tripped. As well as bit of R&R in each of our locales. In Tamarindo we had slow mornings, and then a chef and assistant came in each morning for a hardy in-house breakfast, which was a great way to start to the day. Our friend Zion Colon, a local wrestling stud, had to drop some quick pounds for his weight class when he got home - which he did, then got the blue ribbon in a match.

Summary of places we stayed on this trip -

Tamarindo - busy beach town.

Playa Grande

Sardinal - SuitTrees

Rinconcito Lodge

I hadn't travelled in awhile to areas where both the other guests and the lodging staff were lackluster in their English. Up in the volcano lodge, the french and germans and luxemburgers were all of an older ilk and less so good with their english - it's a big world out there, you forget we aren't the center of it for everyone walking this planet.

Costa Rica, 2025

Lana Del Raye’s Turn the Light On has been a favorite song of my mine for nearly a year - long enough that you start to fear the shine is rubbing off the pronounced affect each listen provokes; the song slides by a little quicker, a little more unnoticed; subtle at first and then obvious. Always a sad turn of the cards.

I’m reading All the Pretty Horses, having just finished a book I really enjoyed that I can't recall at the moment. Audiobooking a Michael Lewis book on the crash of 1929, as he and many others try to establish, or at least warn against, the parallels and similarities of the boom we are experiencing now with those of studied history. For while the past doesn’t always repeat itself, there are similarities many times. Artificial intelligence is big and life changing for sure, but so were railroads, airplanes, telephones, radios, cars, televisions, indoor plumbing, the computer, internet/broadband, cell phones and hundreds of other examples - most if not all of the abovebeforementioned were viewed as so society-changing with a potential consumer market so large as to accommodate any level of investment or speculation.

Turns out history teaches us a simple fact - that two opposed things can be true at the exact same time - that the consumer market was large enough to accommodate generations of growth in the respective industries, and at the very time produce cycles of creative destruction, a pruning of the winners, a liquidation of the losers, retrenching and then growing again.

The retrenchment is painful because the bull markets and go go times last longer than they should and investors get greedy, abandon diversification, chase gains, and sometimes borrow to amplify gains. Even conservative investors can capitulate to the FOMO and reduce their strategic diversification and chase the hefty gains everyone else seems to be booking.

New barn house in SuCo in private lake community, for sale.

4000+ 4/5 bedroom barn house for sale in Kerhonkson on 30 acres.

Installed a modular pool in Narrowsburg from our company Catskill Modular Pools.

Then bam, the music stops, the musical chairs are quickly filled, the Titanic lifeboats are loaded up in a frenzied and inefficient fashion, and panic sets in then you really have a circus as people who know they’ve pushed the limits of their risk tolerance sell into the down market, accelerating it, and then it feeds into self in a vicious cycle.

That’s when it’s good to have cash on hand.

The stories that will be written about this crash and correction when it happens have been heavily foreshadowed - the big ETF’s which were supposed be a model of diversification became very top heavy with the big tech stocks to boost returns; that the market gains for the last few years were easily seen as deriving from only a few of the many stocks in the market with the rest of the market lackluster or worse.

The thing that will suck is that a lot of the people that will be hurt by a 3-5 year correction are the boomers who kept their 401k’s a little too aggressively for a little too long and now living off a sizable nest egg reduced by gyrations of the market.

Thanksgiving family gathering.

I really don’t know why I care, I just find it interesting. I can write intelligently about the market psychology like I have above because I can self-examine my own inclinations and have done enough reading about it, past and present, to put it into context. But big picture stock market risk, my over-all portfolio, even if the whole thing was disproportionately and overweighted in Technology, still leaves 60% in other things, mostly real estate.

Broadly diversified, mostly pretty liquid real estate. Some homes, some rentals, some land, some income producing, some spec homes, in multiple states, multiple markets, 15-25 real estate investments with a lot of disconnectedness among them, so there would be little contagion in a downturn. And the relationships to keep the whole thing steered well. An income coming in from business, rents and mortgages held.

I’m becoming pretty bullet-proof, which for someone who hung out on a shaky tree branch for the better part of 2 decades, that’s an interesting feeling, and even after it sort of became clear that’s where I was heading, it takes the brain a few more years to overcome the dopamine and stress that feeds the appetite of the day, and then at some point each individual who did spend decades gambling gets to decide individually if they would like to wean themselves off that mainline fix, or live in that zone of perpetual stress and anxiety that can fill lots of hours in a day in a productive and consequential fashion.

But for me, individually, I’m not looking for a ‘performative retirement’ or 3rd Chapter - I’m looking to be able to sit still, both body and mind, and let life and its ups and down pass through me as a river flows. Any activity can be approached with a need to instill it with an edge, or a rounded smooth pure vida playbook.

Speaking of Pura Vida, I’m on my way to Costa Rica, Guanacaste Region, with my wingman Eli, Lucas and two of his friends. This is my 3rd or 4th trip down and I already wish I planned more time for it.

New Ranch house in Narrowsburg NY, for sale.

It’s funny this life I’m living with these leisure expenses - as someone who has watched business and personal expenses closely for a long time, for a real reason of survival - a nag of scarcity tags every dollar I spend, every day. The feeling may linger, may pass quickly, may be hardly notable, or may be pronounced, but it’s there. I’m not the guy who doesn’t feel the sting of spending, even if I stopped really noticing how much things cost awhile ago - on a personal front, business-wise I spend intelligently and never look back at amounts that dwarf anything I'm doing personally. That’s a transition too - from scarcity spending mindset to enjoying the freedom of responsible spend-thriftiness. You hear a lot about that from retirement / financial advisors- how a life time of savings makes the twenty years of spending without income in retirement a tough mental pivot. I can see that.

Mi casa en Milford.

The amount of strategic thought, and then execution/implementation my Catskill Farms teams has undertaken over the last 3 months has been extreme, and spread out across the new talent I have both in the office and in the field. From scouting land, to making deals on that land, to the contracts and due diligence (surveys, septics, etc…), to house/land pairing, to building permits to foundations and frames and land clearing and driveways - across 3 or 4 counties. Feels good to be killing it again, at this level, with this type of precision - both client-based and construction- based. You can have all the hard-earned experience you want, but you can't even begin to leverage that well without a good team with talent and potential and attitude.

And potential is important to me because no matter how good you are at Catskill Farms, I got something new for you to learn when you begin to understand your current tasks at hand. No one literally has ever left my employ without real progress in their skill set and marketplace attractiveness.

One night in this tree house not far from playa del coco.

Stopped by to help a client Bill test out his fireplace since he was having a big dinner party and it never been fired up before - they live mostly in Southern CA. It was a masonry fireplace from top to bottom, as opposed to an 'insert'. Old school process and craftsmanship. Thing drafted and burned amazing.